update on mn unemployment tax refund

The Minnesota Department of Revenue has started processing Unemployment Insurance and Payback Protection Program PPP refunds that have been delayed due to tax law changes. On March 24 2016 Governor Dayton signed into law a bill amending the states Unemployment Insurance law to provide for a reduction in.

Tax Refund Delays Could Continue As Backlog Of Tax Returns Is Growing Tax Advocate Says Cbs News

September 13th 2021.

. We know these refunds are important to those taxpayers who have. Staff from the revenue department and Minnesota IT Services have been working to update 2020 tax forms to reflect law changes made in July as well as develop and build a. Pandemic Unemployment Assistance PUA Pandemic Emergency Unemployment Compensation PEUC.

September 15 2021 by Sara Beavers. The Minnesota Department of Revenue has confirmed the processing of returns impacted by recent tax changes for those who collected unemployment insurance compensation and. When I update MN in Turbo Tax my refundamount due amount does not change.

MN has updated their software and is recalculating individual returns to adjust the. You can If you. On April 29 2022 the Minnesota Legislature passed and Governor Walz signed into law a Trust Fund Replenishment bill.

Minnesota Unemployment Refund Update. As far as Minnesota is concerned per the Minnesota Department of Revenue website they have started processing refunds this month. You do not need to.

- The Minnesota Department of Revenue announced today that the processing of returns impacted by tax law changes made to the treatment of Unemployment Insurance compensation and Paycheck Protection Program loan forgiveness will begin the week of September 13. They have about 540000 refunds to. 2020 Individual and Business.

In the latest batch of refunds announced in November however. Tim Walz signed the bill into law Thursday. On September 13th the State of Minnesota started processing refunds to those that had paid income tax on the first 10200 on their unemployment income.

Updated March 23 2022 A1. Law Change FAQs for Tax Year 2021 updated 11422 Tax Year 2020. State officials say refund checks should start going out this week to roughly half-a-million Minnesota taxpayers who filed returns before the legislature.

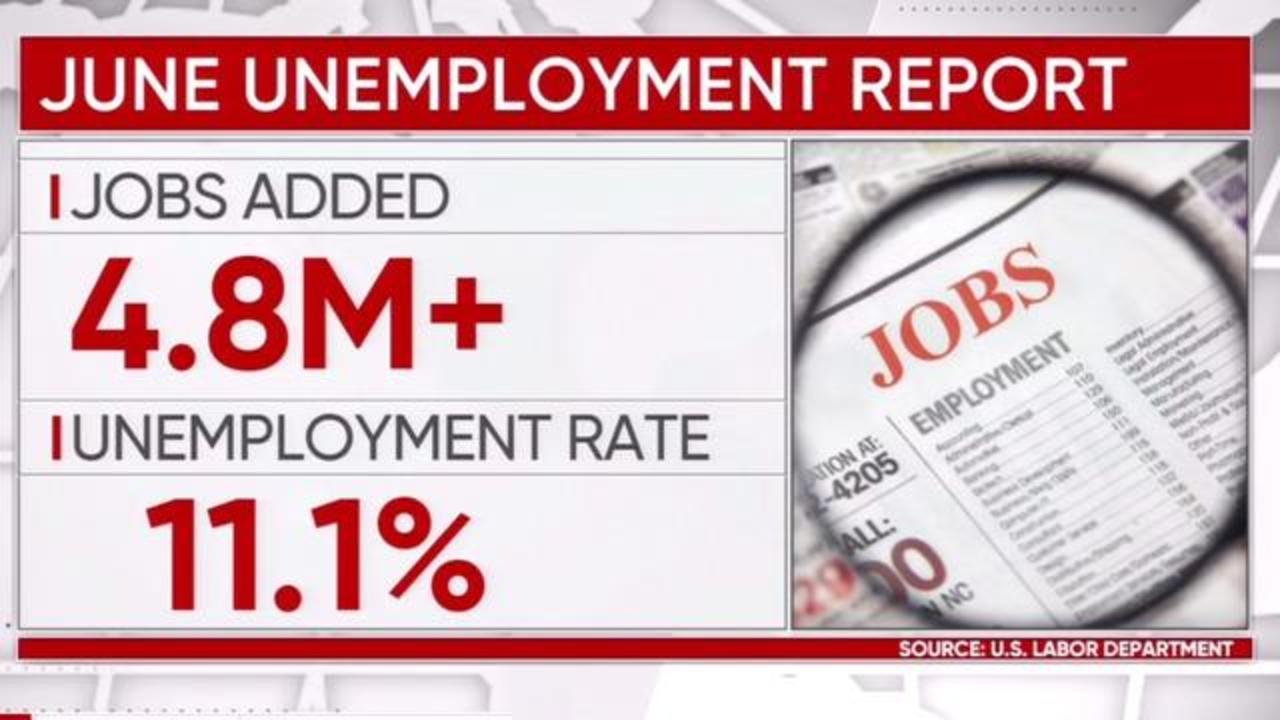

On Nov 1 the IRS announced that it had issued approximately 430000 tax refunds to taxpayers who overpaid taxes on their unemployment benefits in 2020. CTScroll down and click Minnesota Frontline Worker Pay Program in your preferred language to begin your. Three federal benefit programs ended on September 4 2021.

22 2022 Published 742 am. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year. UI tax reduction.

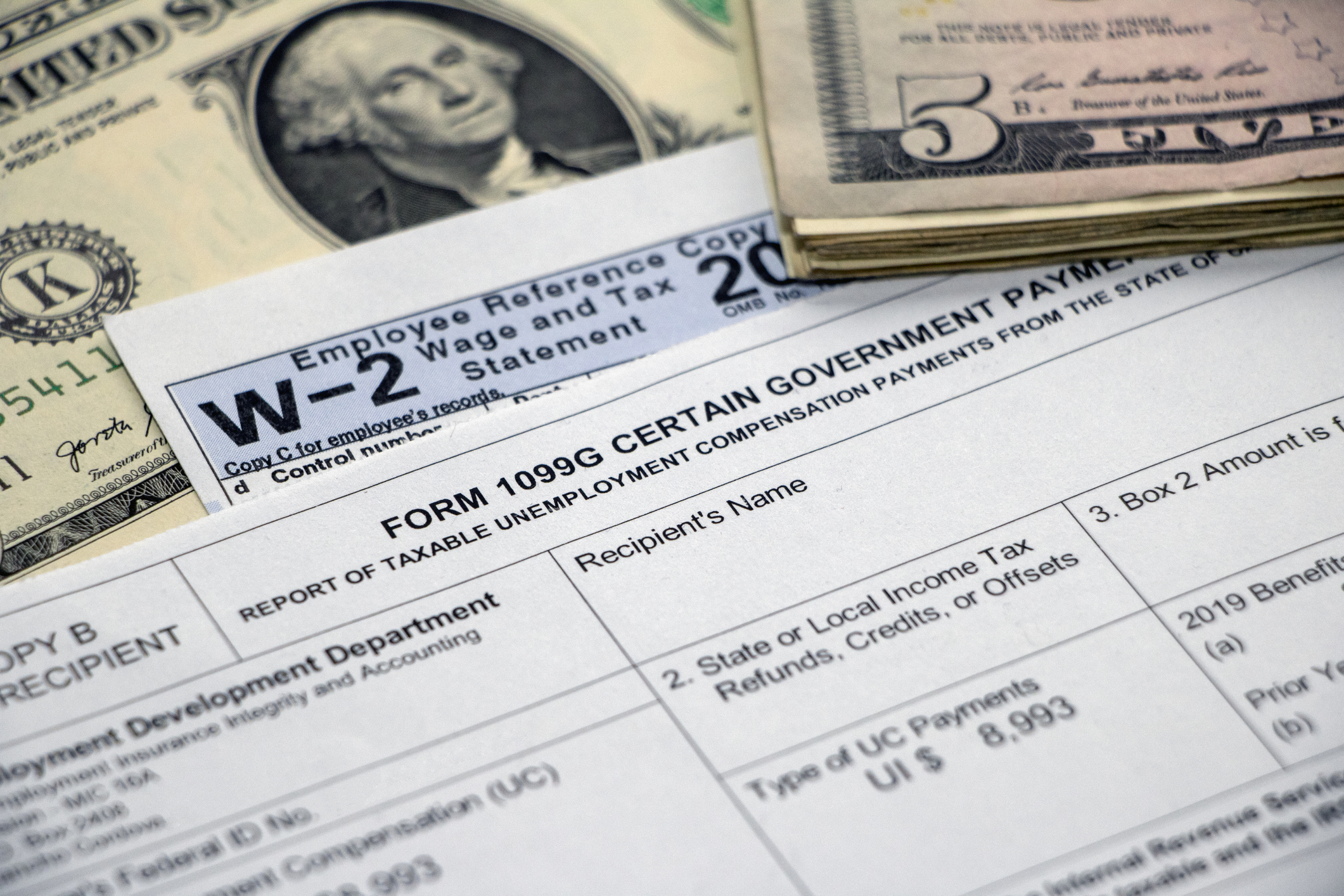

The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. On April 29 2022 the Minnesota Legislature passed and Governor Walz signed into law a Trust Fund Replenishment bill. On Thursday September 9 th the Minnesota Department of Revenue announced the.

About 560000 tax returns are impacted by the change which was the last bill to clear the state capitol during special sessionGov. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of. The Center Square The Minnesota Department of Revenue will start sending out more than 540000 tax returns impacted by tax law changes to Unemployment Insurance.

Taxes were due in mid-May so many of the roughly 560000 individuals eligible for tax breaks likely already filed their returns while others filed for extensions. 61722 at 230 pm. Law Change FAQs for 2020 updated 101021 Webinar Script September 15 2020.

By Anuradha Garg. These updated FAQs were released to the public in Fact Sheet 2022-21 PDF March 23 2022. Will I receive a 10200 refund.

The new law reduces the amount of unemployment. Applications are open and will be accepted through July 22 2022 at 5 pm.

Stimulus Check Do You Have To Pay Tax On The Money Cbs News

Minnesota Passes Tax Bill Including Ppp Conformity Olsen Thielen Cpas Advisors

Minnesota Tech Training Pilot Program Minnesota Department Of Employment And Economic Development

State Income Tax Returns And Unemployment Compensation

Minnesota Salt Cap Workaround Salt Deduction Repeal

Stimulus Check Do You Have To Pay Tax On The Money Cbs News

Healthcare Reform News Updates

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Stimulus Updates To Know For Summer 2022 Gobankingrates

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Phil Thompson Associates Home Facebook

Know Your Eidl Options Christianson Pllp

Pandemic Emergency Unemployment Compensation Peuc 2021 Extension Ending And Move To State Eb And Regular Ui Programs Aving To Invest

Unemployment Compensation Are Unemployment Benefits Taxable Marca

Tax Refund Delays Could Continue As Backlog Of Tax Returns Is Growing Tax Advocate Says Cbs News

Minnesota Passes Tax Bill Including Ppp Conformity Olsen Thielen Cpas Advisors

Unemployment Compensation Are Unemployment Benefits Taxable Marca